Do you want to sell products or services directly on your website, but you’re not even sure where to start with online payments?

There are soooo many options out there. While most of us would like some way to take credit cards and make payments from our clients super simple, the fact of the matter is that not all payment options are as simple as they look.

In today’s blog, I’m going to break down a couple deciding factors, compare the two biggest online payment options, and walk you through what you’d need to add to your website to get it done.

Are You Selling Services or Products?

First, let’s determine whether you’re selling a service (i.e. a coaching session or consulting program) or some kind of product. Your product can be digital; for instance, I have a client that sells legal contract templates.

When you’re selling a product, you tend to have a set price for that product and you’re OK if literally anyone purchases it.

If you’re selling a service, you might need to customize the quote a bit, want to vet the person purchasing the service, or require them to agree to some policies before they purchase.

While you can certainly sell services a lot like digital products, it all depends on what you’re looking to do.

With a product, you’re much more likely to have one payment; they purchase, pay once, and get their digital product. With a service, you’re probably going to have a higher ticket option and break down the cost in payments or even in a recurring payment structure.

Not sure what yours would fall under? Consider whether or not they’ll be able to just pay once or whether you know you’ll need to allow some recurring/repeat payments of some kind.

Payment Processors

With the idea in your head of what kind of item you’re selling, let’s talk how you take that money.

You can certainly work with your local bank and set up a merchant account that allows you to use an online gateway like Authorize.net, but honestly, that gets complex. And you have to go through the PCI Compliance process which can be overwhelming.

In the online payments marketplace, there are really two user-friendly options at your disposal – Stripe and PayPal.

Stripe vs. PayPal

Both Stripe and PayPal allow you to accept credit card payments pretty easily, directly on your website. They’ll work with a variety of WordPress plugins or you can use their own built-in products and shopping carts and just provide a link to their platforms for someone to check out.

While they’re relatively evenly matched in the services they provide, what it comes down to is cost and the options they take for cards.

PayPal is great for your customers that are already used to using PayPal and have an account. PayPal has some good “pay later” options as well, but it’s a bit more limited in the payments it accepts. Transaction fees also tend to be a little higher with PayPal. You’re looking at 2.59%-3.49% + $0.49 per transaction (depending on your plan & other factors).

Stripe is a little more web developer friendly (and thus one reason I like it), but still super easy for the non-tech person to use. They also accept ACH Payments, ApplePay, GooglePay, MicrosoftPay, numerous foreign payment methods, along with credit cards and debit cards. That just gives you a few more options for your customers. Stripe’s fees stay the same, too – 2.9% + $0.30 per transaction. You can also set up recurring payments in Stripe, which is a bonus if you want to sell subscriptions of some kind.

Both of these options are already PCI Compliant, so there’s not anything more you need to do to prep your website. You simply need to set up an account, connect it to your bank, and get it on your website.

Using a Payment Processor on Your Website

Now that you’ve selected how you want to take payments, you need to set up a way to take those payments on your website.

As I mentioned, both PayPal and Stripe allow you to set “products” within your account and add a Purchase link to your website. But you can also integrate both accounts with a variety of eCommerce solutions available through WordPress.

Option 1: WooCommerce

One of the largest eCommerce options is WooCommerce. A fully customizable solution, it allows you to add a variety of extensions and options to build a robust online store. WooCommerce includes free plugins for both Stripe and PayPal, allowing you take payments with either or both credit card processors. You just have to install the correct extension, follow the instructions to connect your account, and you’re pretty much good to go.

You won’t be able to actually sell anything through WooCommerce until you’ve set up how you want to take payments, though, so make sure you do that first thing.

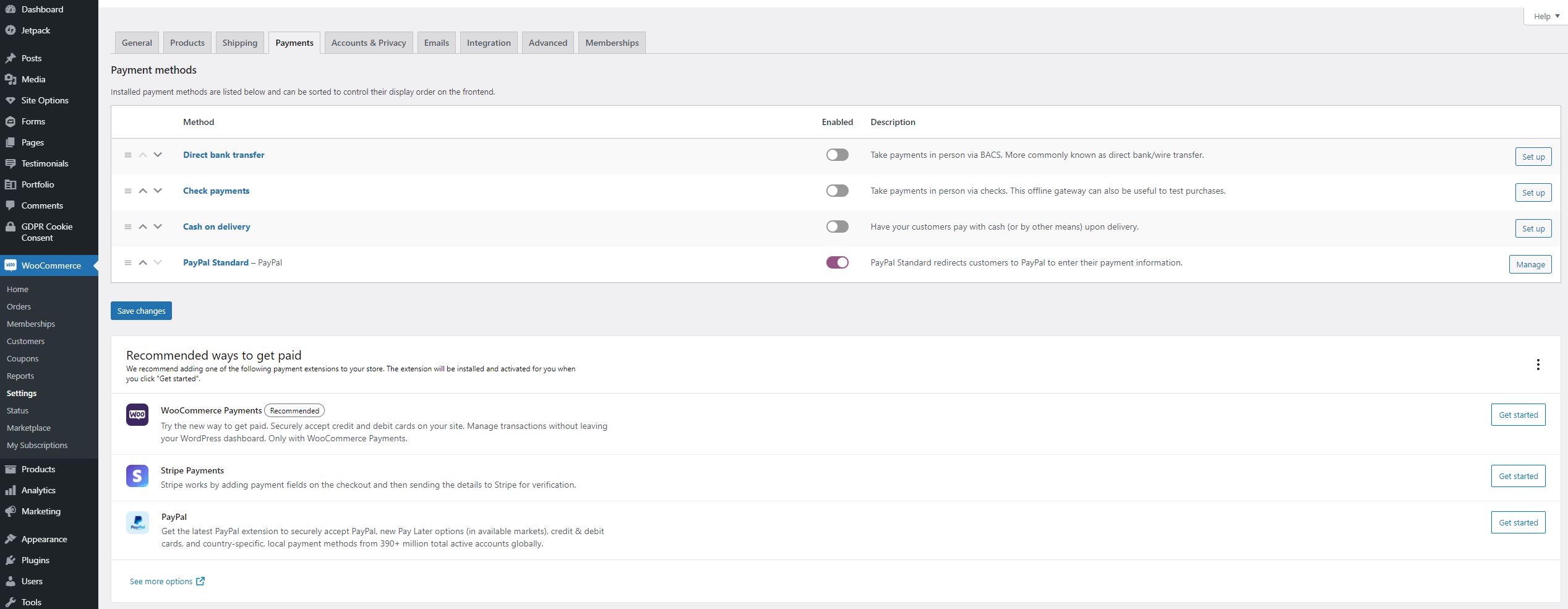

You’ll just need to go to WooCommerce > Settings > Payments and they even give you a quick walkthrough on how to set everything up.

WooCommerce is great if you’re selling digital products or something with a set price. You can have variable products, too, but it’s more about the quick purchase experience.

Option 2: Gravity Forms

If you only have one or two products, want to gather more information while you’re selling something, or simply don’t want to mess with WooCommerce, you can actually take payments using Gravity Forms, too. I’ve talked before about how much I love this plugin, but one of the awesome things about it is you can use it to quickly accept payments directly on your website.

One of the things I love about Gravity Forms is you can capture a host of information about your lead along with their payment. This is especially great if you have some entry questions for your coaching program beyond just needing their name and email. You can even set it up to make those fields required before they can make their payments.

Gravity Forms integrates with Stripe (even allows you to take recurring payments for subscriptions) and PayPal pretty easily. Much like with WooCommerce, you just need to add the relevant add-on and Gravity Forms will walk you through how to connect your account.

Unlike WooCommerce, Gravity Forms is a premium, paid-for plugin. Because it can handle all of your contact forms (and more), you may want it for more than just payments. But to handle online payments, you’ll need at least a Pro license which runs about $159/year.

Definitely worth it for how powerful Gravity Forms is, though.

Recurring Payments/Subscriptions

One thing to keep in mind is if you want to take recurring payments of some kind, or subscription payments, it can get a little dicey with PayPal. While it can be done with some third-party plugins, recurring payments are built into Stripe. Perfect for when you have a monthly plan and just want it to auto-bill for that month’s coaching session, allow access to a membership area of your website, or sell any other kind of subscription based service.

WooCommerce might require the WooCommerce Subscriptions extension to get everything to work the easiest for you ($199/year), but Gravity Forms can actually handle Stripe’s recurring subscriptions natively. And Stripe actually lets you set up recurring products in their app, so there’s a couple ways to get around that.

Taking Online Payments

Want to know a secret? Dealing with eCommerce and taking online payments used to be my least-favorite thing. In fact, it down right scared me. Luckily, there are so many tools available to us now that it’s so much simpler. Honestly, Stripe and PayPal both, with a few other plugins, can be easy enough for any non-technical person to set up.

But if online payments scare you or you’re just not sure where to even start, you can always set up a discovery call with me. Let’s see what your best options are!